A tax invoice format is a legal and highly professional document which is issued by the registered business vendor to a registered purchaser, no matter whether it is in soft copy or in hard copy. Basically, there are two main types of any invoice; one is the tax invoice and the other is the retail invoice. Whereas, the main difference between both of them is a tax invoice is not provided to the user of the commodities purchased, and the retail invoice is issued by a business vendor to a client when he or she purchases commodities. The tax invoice format provides legitimate evidence for a recipient to claim tax credit for the commodities that he or she purchased. There are certain cases where it is issued when the purchased commodities are delivered to the recipient. Similarly, if there is a delay in delivery or shipment is taking time, this invoice is issued before or at the time of dispatching commodities.

What is the Purpose of Using a Tax Invoice Format?

The purpose of issuing an invoice is to let the consumer know how much amount they need to pay to complete the transaction. Whereas, these tax invoices are important documents in any country and play a key role in making the tax system better. The primary purpose of a tax invoice is to recognize transactions in the state’s tax system. In addition, this invoice helps buyers, sellers, and tax authorities to understand and process the tax due on specific sales transactions. As far as the main difference between a tax invoice and a regular invoice is concerned, a tax invoice includes vital information related to general sales tax, which a regular invoice doesn’t.

What to Include in the Tax Invoice?

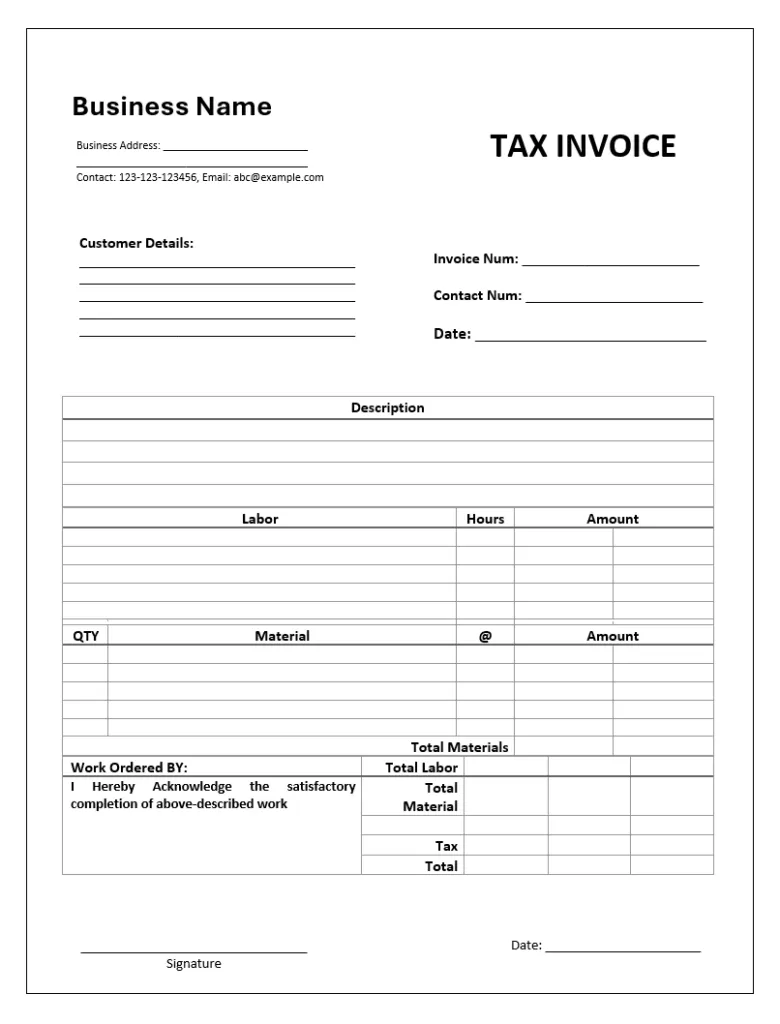

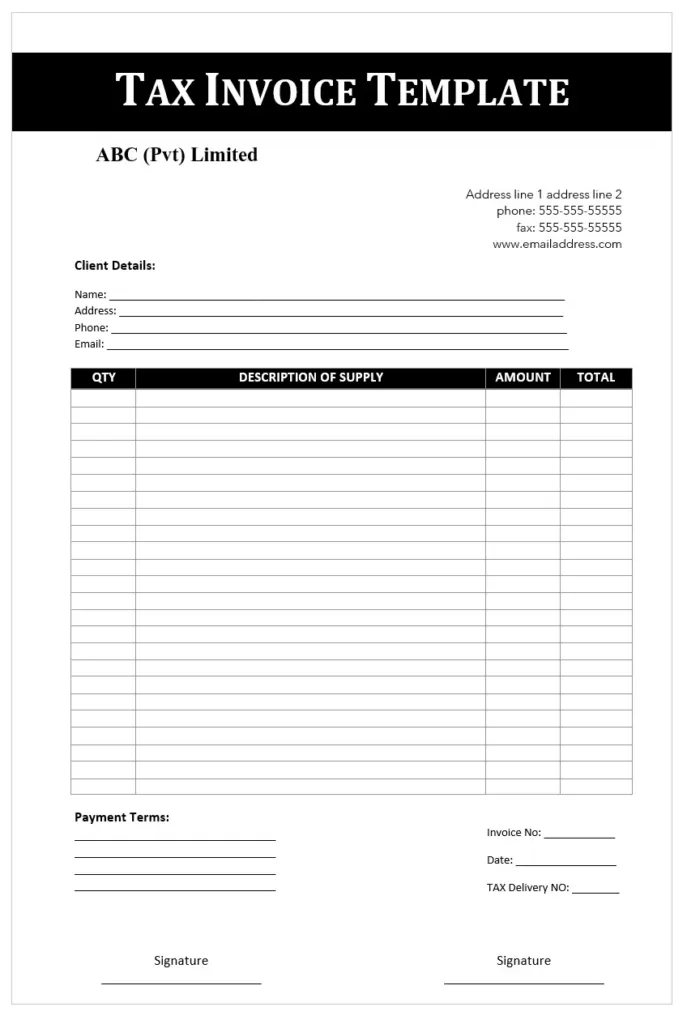

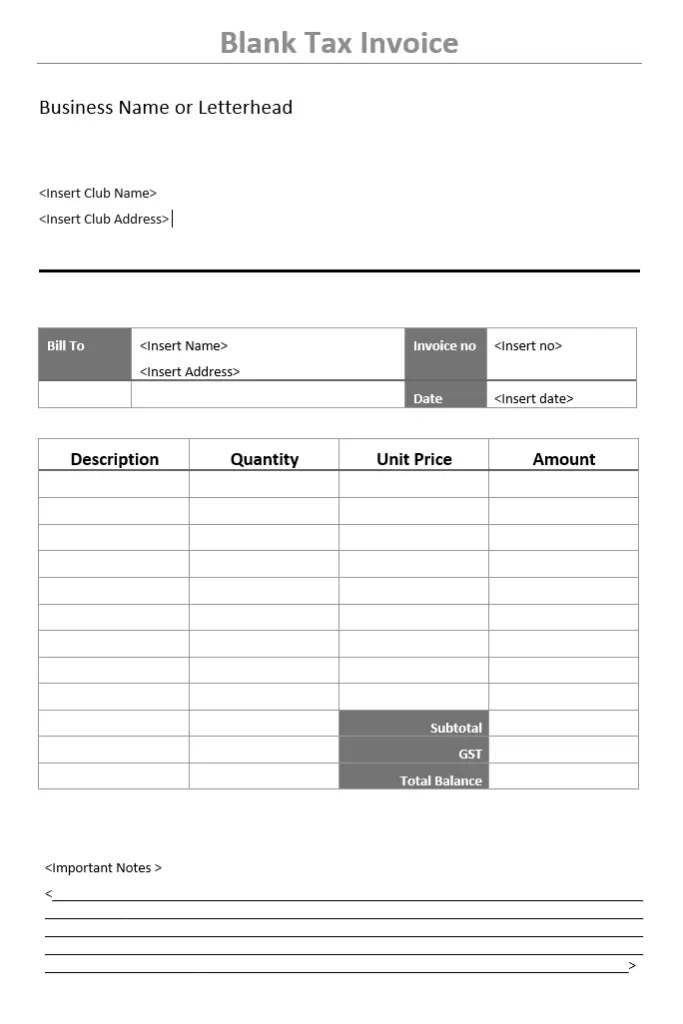

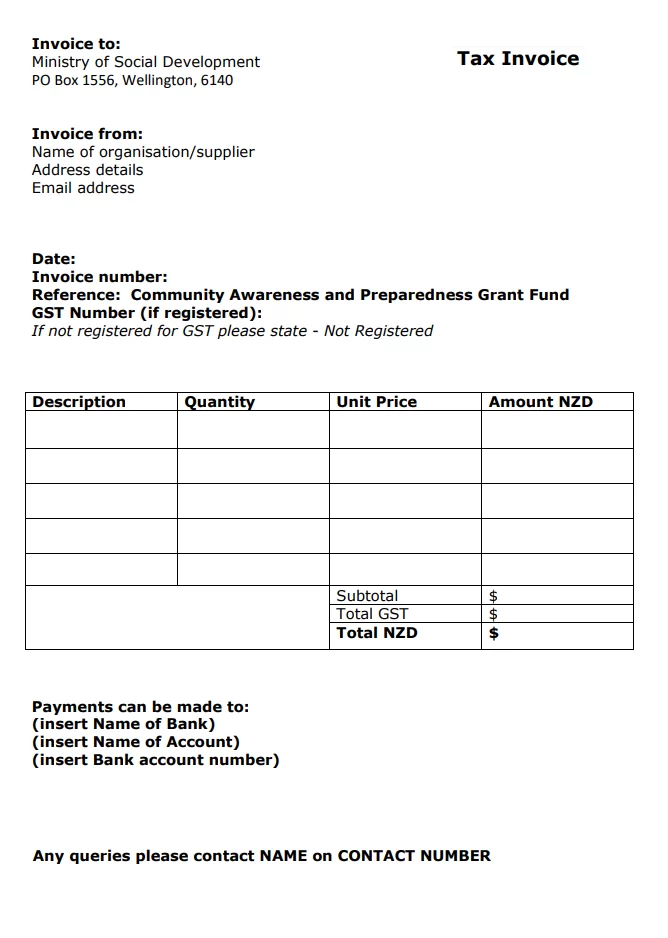

There is no hard and fast rule for preparing a tax invoice. Any company can make changes to its format according to their needs. There are some basic details which are almost required by all.

• Header: The main heading of the document must be ‘tax invoice’ instead of just ‘invoice’. It indicates the type of invoice.

• Date: The date on which the invoice is issued is required to be mentioned as well, and it is one of the important steps.

• Identification Number: A unique invoice number is provided for each invoice. It will give every invoice a unique identity and assist in managing and tracking records.

• Contact Details: The contact details of all the parties involved in the sale are required to be mentioned, which includes the name, address and e-mails.

• Description: A description of the items sold, including the quantity and the prices is mentioned. In this column the total amount of tax paid along with the due amount is mentioned.

Templates for Tax Invoice:

www.msd.govt.nz

www.msd.govt.nz