A salary statement template is a detailed record of an employee’s net salary along with any sort of deduction made from it. A company is legally bound to make records of each employee as proof of employment and salary payments, whether that may be a high-earning employee or an intern. After each month, a salary statement is generated which is kept in the records for a time being and is only given out when it is required by the employee. Employees generally ask for their salary statement if they find any mistake in their salary payment or if the employee decides to resign from the company, considering presenting a salary statement is necessary for a new job.

Importance of Salary Statement:

In a few cases, employees may need salary statements from the company. The employee then writes a letter to the accounting department of the company for further procedures. In response to this letter from an employee, the accounting department of the company writes a letter back that consists of all the details of an employee’s salary and deductions. This may be delivered to the employee in the form of a hard copy letter or in the form of an email.

Components of a Salary Statement:

The salary statement consists of a few components that are delivered from the accounting team to the employee.

Basic income: this part is the most important as it tells the basic salary of the employees. It serves as a basis for determining the other components of the salary statement. It forms up to 45% of the total salary. As an intern, the basic salary is quite low, but as the rank of the employee grows, the basic salary as well as the allowances seem to grow.

Dearness Allowance: This allowance is given to offset the impact of inflammation. It forms about 20-30% of the basic pay. It is different for different locations, as it is directly based on the cost of living. This feature is normally issued to government employees.

House rent allowance: this feature is given to employees who live in rented apartments. This forms 50% of the basic pay for metro cities and 40% of the basic pay for individuals in other cities. This feature is exempted from any sort of tax.

Medical allowance: this allowance is an amount that the company pays to the employees for medical expenses during the time of employment. The employees can only receive this amount on proof of medical bills from the company.

Conveyance allowance: Conveyance allowance is the amount of money that is given to an employee to travel to work and back home. This basically refers to the money you can use for transportation to travel to work and then back home.

Leave and travel allowance: this allowance is given to employees to cover the cost of travel on leave. It covers all the expenses spent on transportation or tickets. It is given per the number of members in the family. Proof of the travel tickets is necessary for the allowance to be issued.

Special allowance: this refers to an allowance given to employees based on their performance. It depends on the amount of extra work or projects they spend their time on. It may also be called a bonus that is given alongside their basic salary.

Templates for Salary Statement:

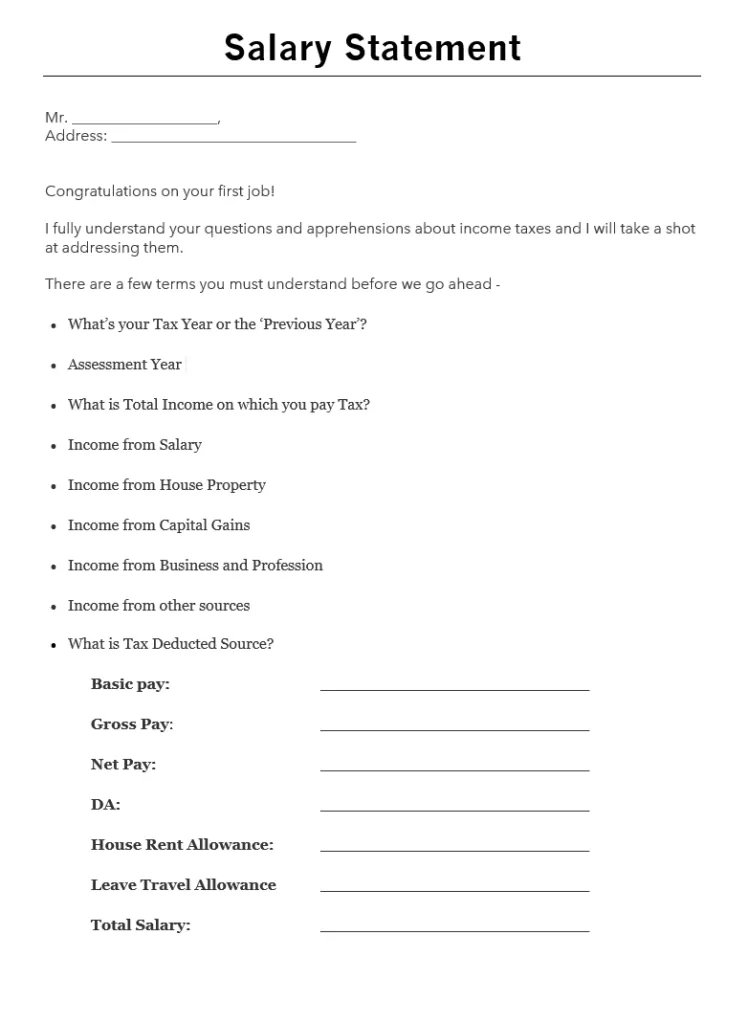

www.labor.maryland.gov

www.labor.maryland.gov

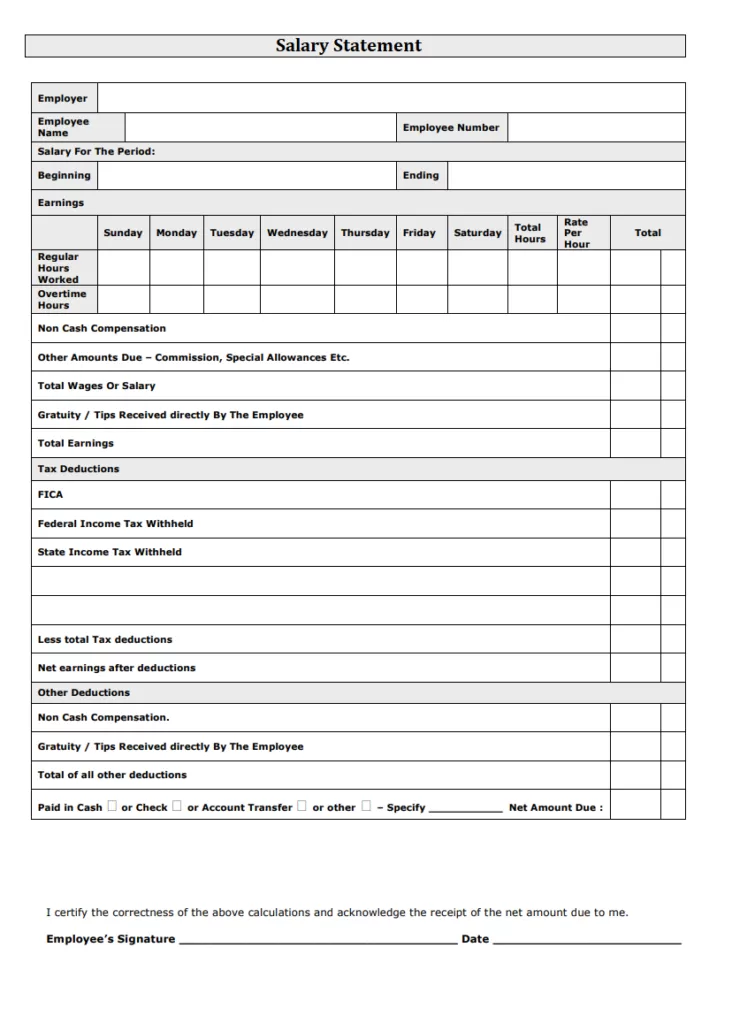

www.businessformtemplate.com

www.businessformtemplate.com

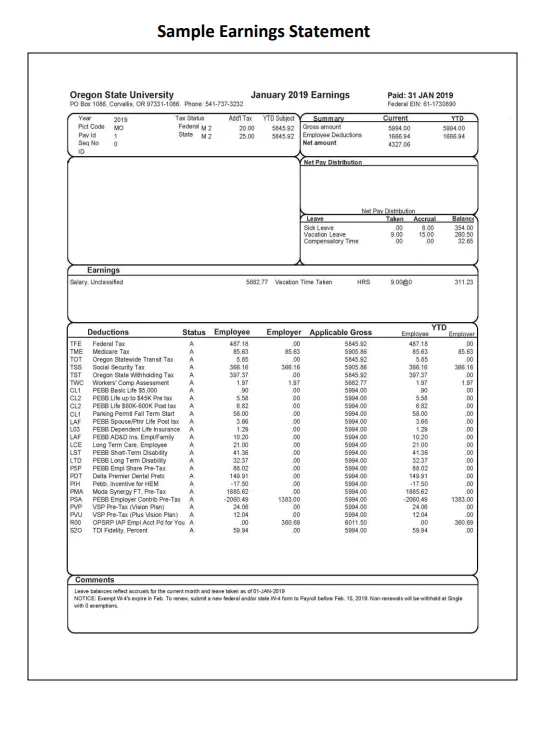

hr.oregonstate.edu

hr.oregonstate.edu