A petty cash expenses template is basically a list of unimportant and small purchases made by the workers or employees of an organization during a specific period of time. These purchase transactions are usually mounted up until the end of the month because of their less amount. However, the employees should get reimbursed whenever they request for it. Petty cash expenses sheet can include minor expenses such as payment made for a cup of coffee, snacks and for lunch. Moreover, small amount expenses made for the manager or any other higher authority in the work place is also included in this sheet. It is ethical for an employee to make a list or sheet out of all these inessential expenses and request for a compensation from management. Such amounts are usually reimbursed by cash because it is not considered practical to make a paycheck for such minor amount.

How to Track Petty Cash Expenses?

Purchases of little amounts are usually tracked in the form of a list. The employee or person can make a reimbursement list of petty expenses in a proper format. Since, petty expenses are usually brought in account at the end of the month or after a long time period, it can become tiring to keep all the expenses and their amounts memorized till then. This is why an efficient method to avoid disregarding any point is to make a rough list at the starting of the month. This list can be on a notebook or even in your phone. Whenever a new purchase is made it can be immediately be noted on along with its price and date. At the end of the month, they can be transferred on the reimbursement list.

Guidelines on Crafting a Petty Cash Flow Reimbursement List:

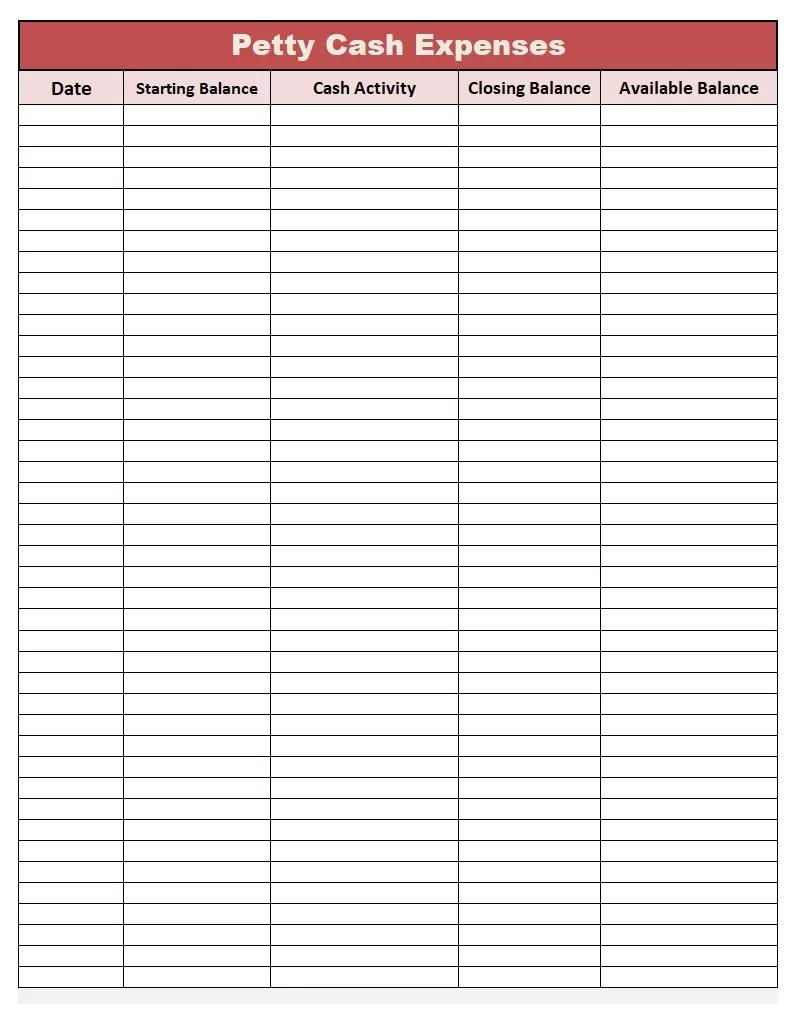

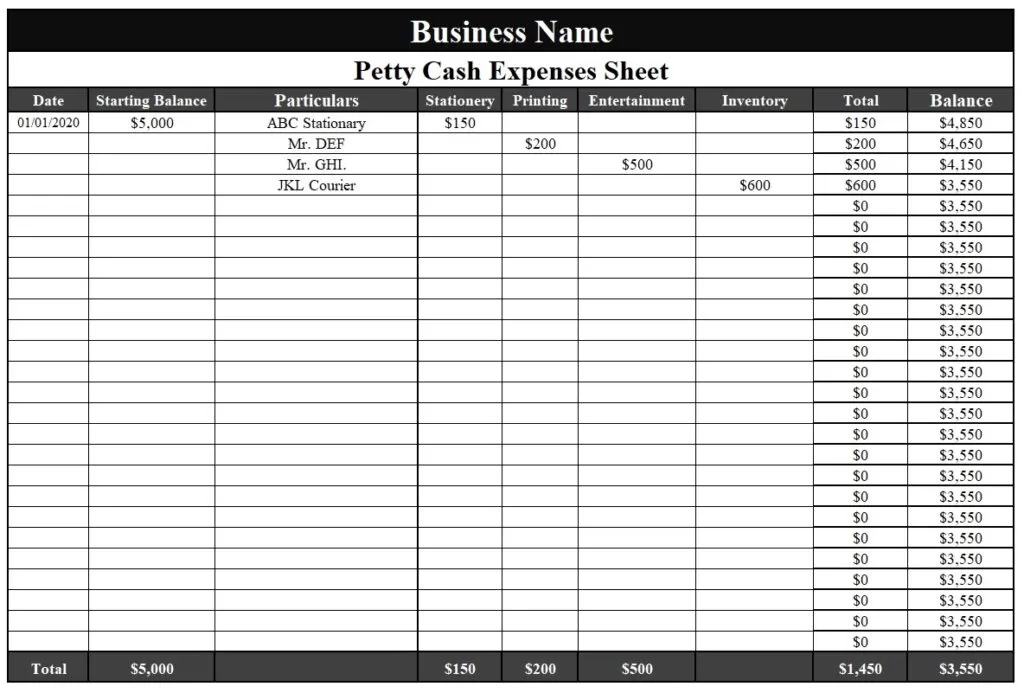

Petty cash expenses are basically cash flow sheets which are very easy to prepare and design. Since, they don’t require much thought, anyone can easily make one on their laptop/computer. The list should contain all the purchase with their proper names, the amount spent on them and the date they were purchased on. A detailed instruction on making a petty cash flow list is mentioned below:

1. The date on which the list is being made.

2. The date of each purchase.

3. The name of the purchase or expenditure (example: petrol, dinner and travelling).

4. The individual amount spent on each purchase.

5. Brief of total amount spent.

6. Amount to be reimbursed.

7. Any additional add on if necessary.

The petty cash expenses template can then be printed out or emailed to the manager or the significant authority. It can also be kept as an extra copy with the employee for the record.

Advantages of Petty Cash Expenses:

• Keeping a track of the petty expenditures is an effective way of keeping your monthly budget in check. This way the employee has a general idea of all the unimportant places they spent their money on for the organization and request for a compensation.

• Because of the small amounts, it is possible for the manager or the authority to forget those expenses. This is why the list acts as a reminder of those expenditures.

• Lastly, it creates a level of understanding between the employee and the employer when the employees get the reimbursed for the money they spent.

Templates For Petty Cash Expenses