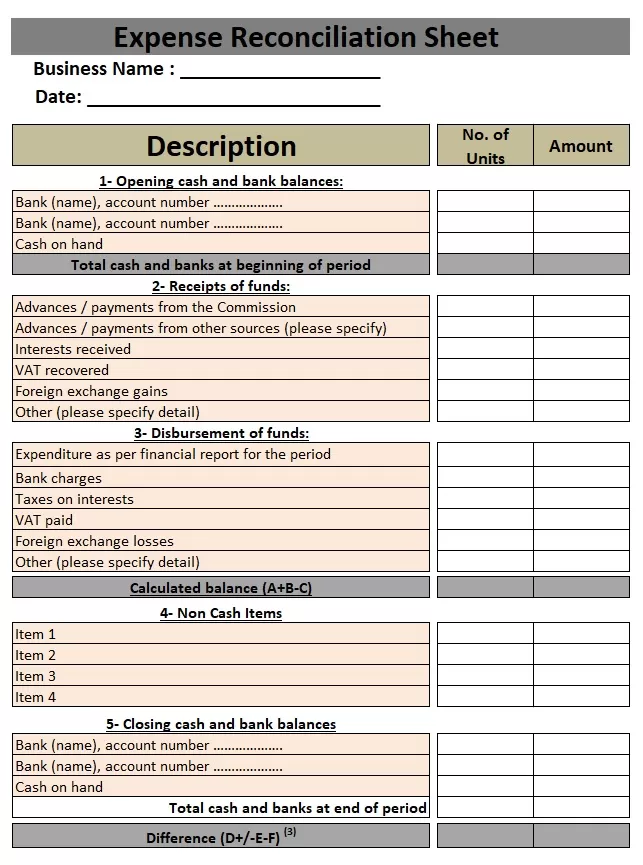

An expense reconciliation sheet template is a perfect way to prepare your own format. Basically, it is a process of matching a company’s expenses with the financial statement of the company, which is recorded by the time by the finance team at the end of the month. The actual purpose of this reconciliation is to match your bank transactions with the bank statement which were recorded throughout the month or year. This activity allows the business owners or entrepreneurs to forecast their company’s cash flow for future disburse accurately.

Importance of Expense Reconciliation Sheet

An expense reconciliation is an elementary process or activity for an organization. It is the job of experts to try to complete the company’s books of account in every accounting period. Accountants have to repeatedly check all accounts over and over of the balance sheet to make sure all stated financial digits are accurate. Basically, reconciliation requires the inspection or verification of two different sets of data to make sure they match. The aim is to make sure that the records are accurate, the income and spending from your accounts are the same as initially recorded, and to point out any frauds or mistakes.

How to Reconcile A Company’s Expenses?

Finance team or accountants of the company, whether large or small, contrasts or differentiates the invoices, bills and receipts against payments claimed in history. It is relatively easy to manage a small company’s account. As you make all transactions by yourself, and you have a record of your own purchasing and spending, in this way your accounts are well taken care of. However, in large organizations, the employees are the ones who are making all the purchases and spending on behalf of the company, it is necessary to verify that all these activities are recorded and accurate. This process lets the organization look over each and every single payment, if it is approved, recorded and that all receipts have been collected or submitted to the company.

Advantages of Expense Reconciliation Sheet

Expense reconciliation format is a mandatory process required to keep your business running for long-term. The main purpose of reconciling the expenses is to keep track of or to manage your capital resource. There are numerous benefits, some are as follows;

• Bank reconciliation is an effective way to detect any unsure transaction from company’s account. Any unauthorized charges or transaction from your account can easily be mottled out when going through monthly bank statement or credit card records.

• Multiple errors in records are common, these errors might seem small in the beginning, but they add up with time and can cause a big loop in the end. These errors include multiple entries in sheet or missing deposit / transactions. Keeping an eye on these discrepancies on your monthly survey is a great way to avoid these errors.

• It is hard to keep an eye on the finances of a running business whether large or small, especially during peak seasons, that is where expenses reconciliation play an important role, to maintain constant balance of your cash or liquidate at the end of every month. It gives you an overall bird eye view of your cash flow.

Template For Expense Reconciliation Sheet