The donation receipt template is a charity document that shows the contribution of donors, whether in-kind or monetary, to an organization. It is sent by nonprofit organizations at the end of the year. This donation receipt is important for both the donor and the organization, as the donor will only be able to receive tax deductions associated with charitable giving if they have any proof of their donations.

Importance of a Donation Receipt

A donation receipt template is an important document for the management of an organization. It is a way of tracking any donations that are received by charity. These receipts help those who are doing the giving to remember how much they have given. Moreover, it is proof that they let the donor know what they have donated and assisted the donor to track their finances. In an organization, proper documentation of every charity transaction is very important. You need to have proof of each donation receipt which is issued. Going further, donation receipts also provide organizations with clear and accurate financial records. While working for any such charitable organization, it is very significant to encourage others for charity as well. These receipts can be used as a tool to encourage individuals to donate. So, these receipts can turn into a lot of great things for your organization.

How can a Donation Receipt be Formed?

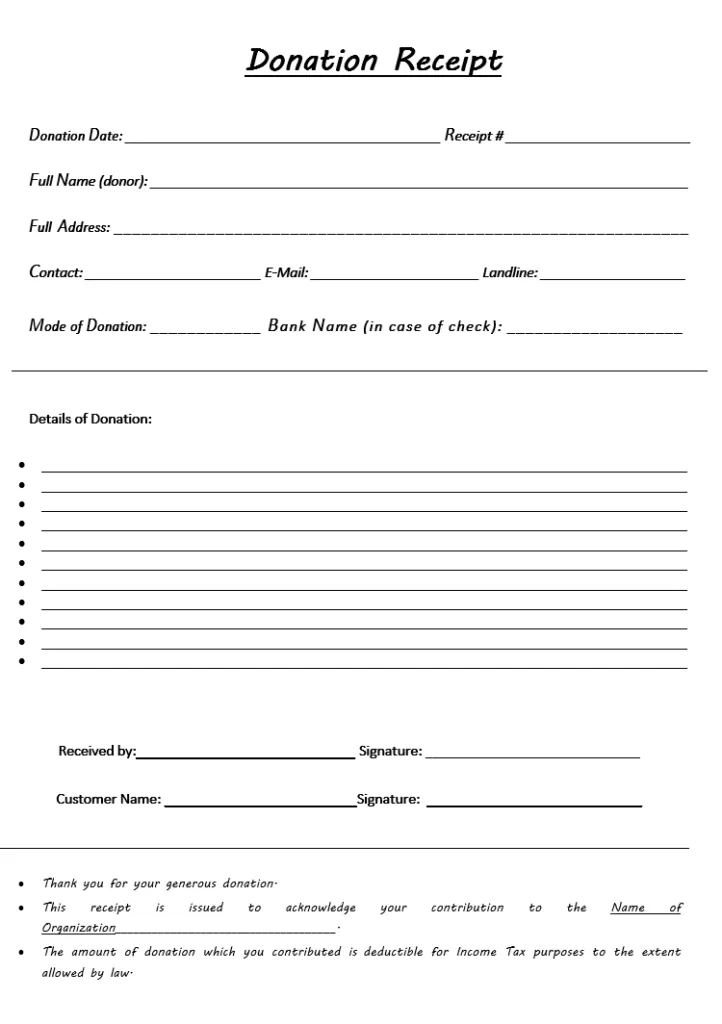

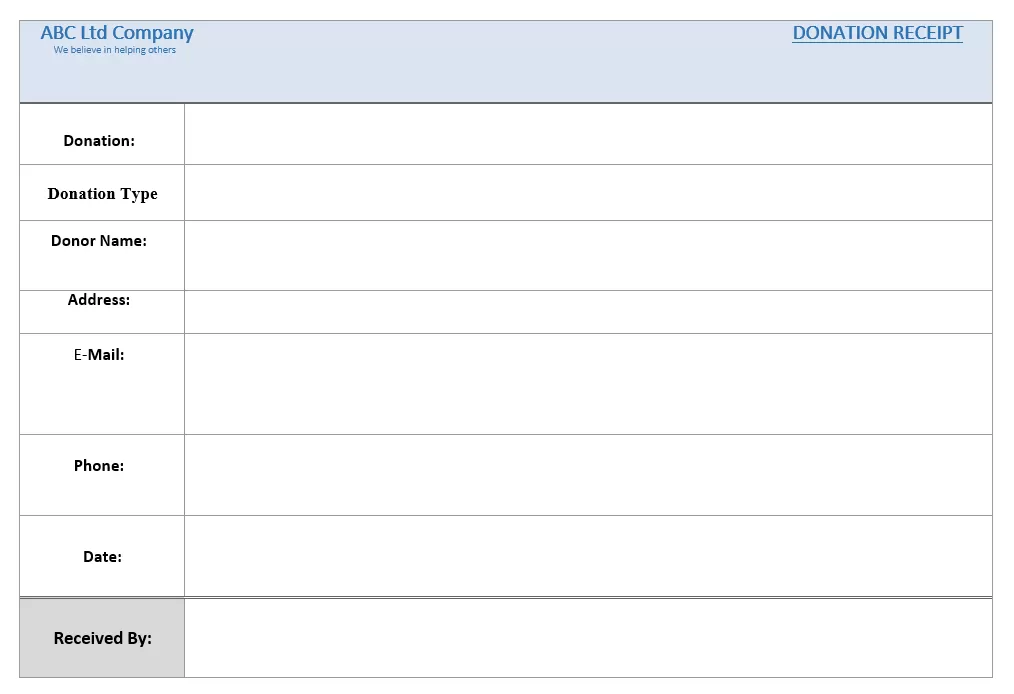

There are no defined standards by which the donation receipt should be prepared. But, while preparing a donation receipt, there is certain information which should be there which is beneficial for both the donor and the nonprofit organization. Whether you are issuing the receipt online or providing it by hand makes it very sure that the format of the receipts is constant. This will make it easier for you to organize your data. Some of the important points which should be part of the receipt are:

• The name and contact information along with the addresses of the organization receiving the donation should be included as well as the contact details of the donor should be mentioned as well.

• The date on which the donation is made should not miss out as well.

• Donations could be of two types. It can be in terms of cash or in the form of items. If it is in cash, write down the amount and if the donation is in the form of items, describe each item donated. If land is donated, then it includes the address of the land.

• Name and signature of an authorized representative such as a board member or head of department.

Templates for Donation Receipt