A deposit receipt template is used to create professional deposit receipts or slips, which are used in many organizations. It is issued to the payer when some amount is paid from the total amount. The payment of the remaining balance will be made at a later time. These receipts are used when someone is purchasing an automobile or other kinds of expensive goods. The main purpose of the deposit receipt is to hold the goods so the dealership does not sell them to someone else. The deposit is also handed over to the landlord by the tenant when the lease begins until the lease ends. If there is no damage to the property otherwise, the amount could be held by the landlord. As far as the banking process is concerned, it is generated by bank officials to confirm the amount is deposited into the account of customer.

How to Create a Deposit Receipt?

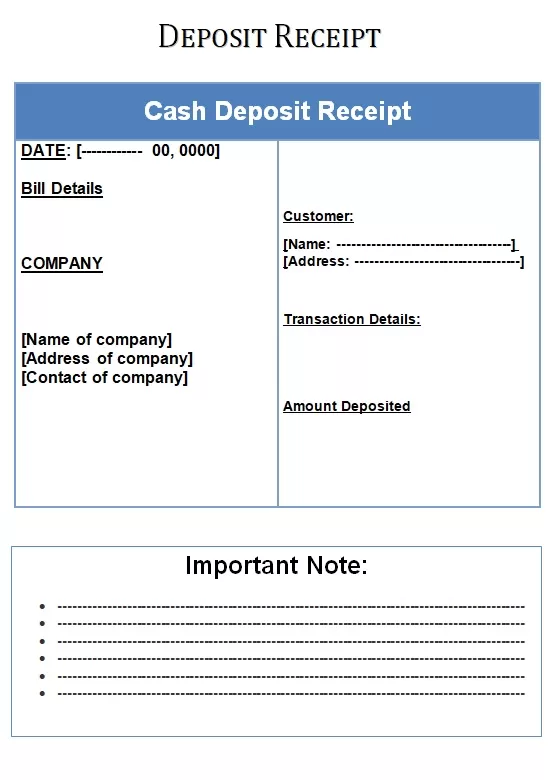

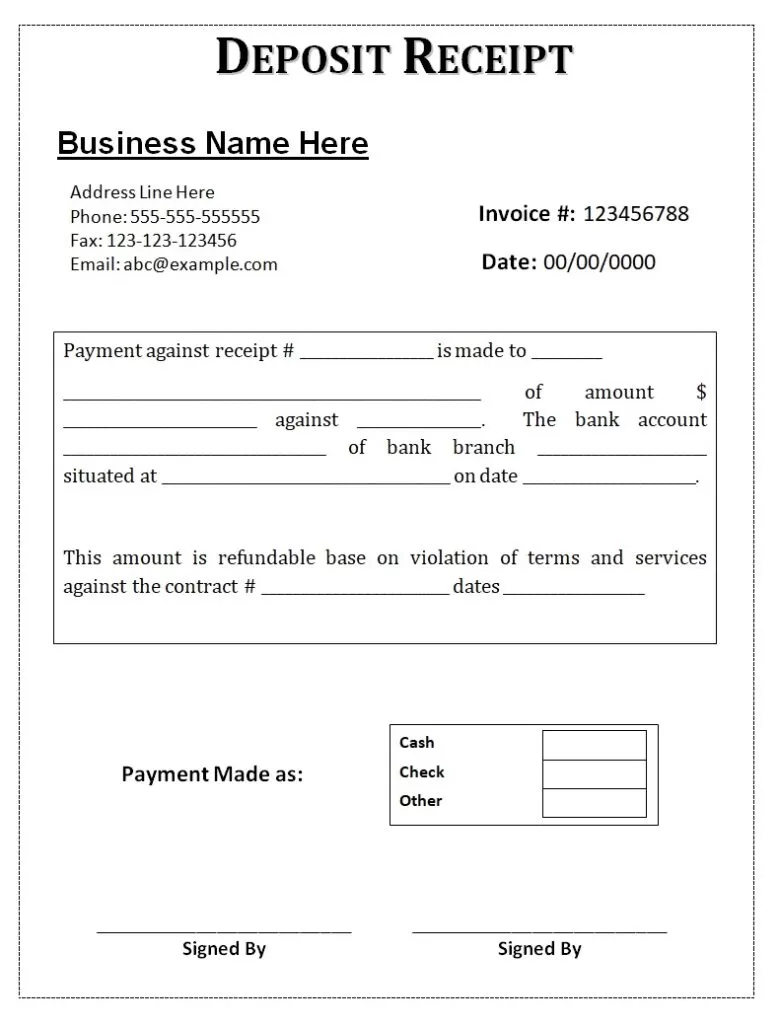

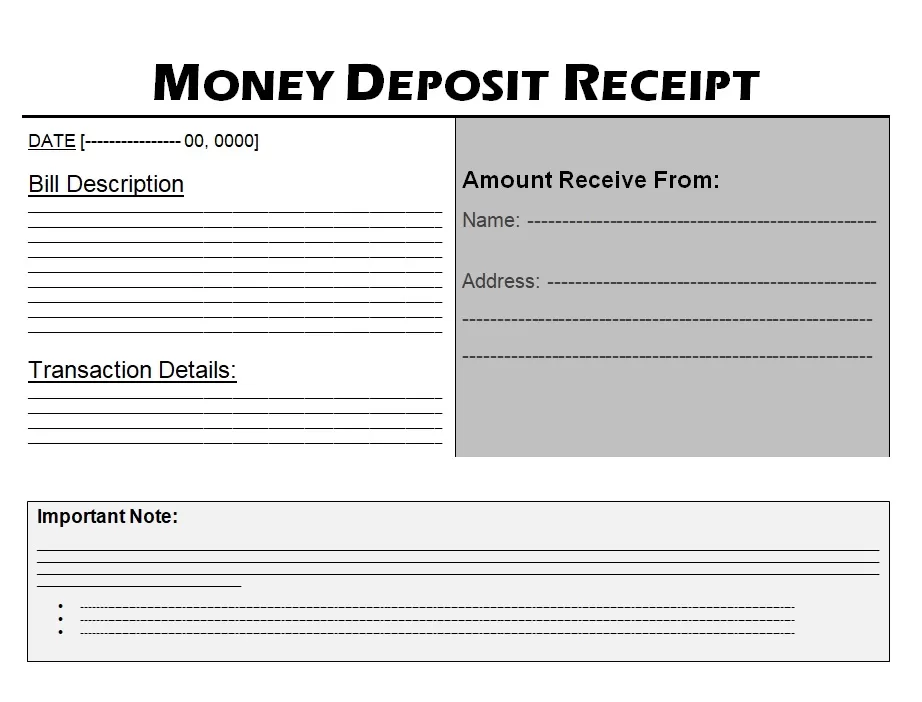

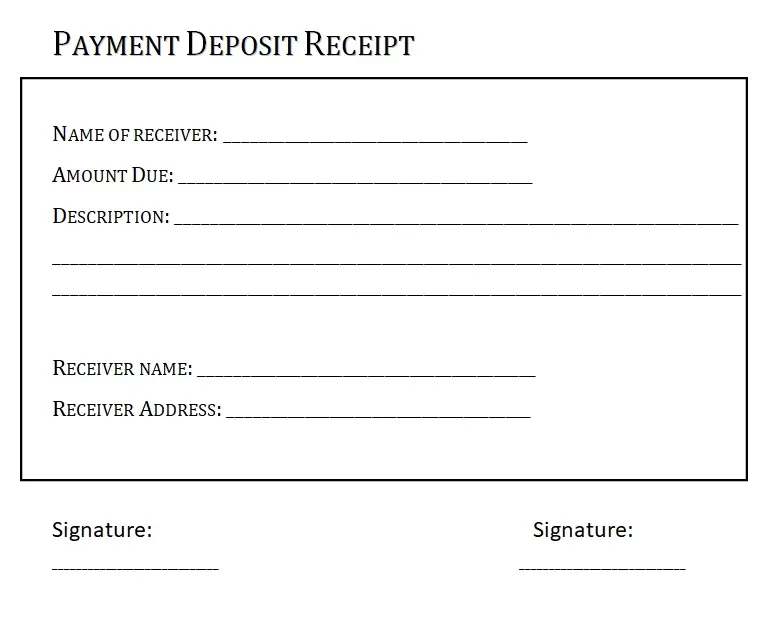

In order to create a deposit receipt, you require typical data which is needed in a standard receipt. That includes a reference number, the date of payment, the amount received, the mode of payment, and the details about the receiver. A deposit receipt is prepared by keeping in mind the requirements and it must be concise yet simple. Keeping the format short doesn’t mean that it is not covering the subject or essential details of the transaction. After getting an agreement, a deposit will be made. It is the right of a payer to have a deposit receipt after payment, especially for cash payments.

Different Types of Deposit Receipts

There are many different types of deposit receipts and some of them are as follows;

• Lets start with a rent deposit Receipt.

• Another one is, receipt for holding deposit.

• People also loves to use a trip deposit receipt.

• Blank deposit receipt is also very popular.

• Don’t forget to include receipt for non-refundable deposit.

• Finally, policies and guidelines of a deposit receipt.

Importance of Deposit Receipt:

The deposit receipt template is an important financial document that is used by the management of the organization in order to control the internal processing of cash. It is issued by the bank and is compared to the total amount of cash recorded in the cash receipts. This receipt is used as proof of payment that has been made in a continuous transaction. In most cases, agreements have a deadline, which lies between one to five business days, for the deposit to be made or the agreement will be considered void. A deposit receipt is prepared or filled in during a transaction or when the due date or time arrives. There are certain cases where an individual is not able to settle his/her debt on the due date. In such cases, the deposited amount is taken back as a remedy. Having a deposit receipt can make it easier for you to manage data and to get the same kind of results every time.

Templates for Deposit Receipt