A credit agreement template is a legal document which secures the deal between a lender and a borrower. The lender lends the borrower a certain amount of money and makes them sign a credit agreement at the time of the deal. This way the borrower goes over all the terms and conditions, deadlines and consequences of any sort of disaster. This document helps both the parties to carry out the deal in a professional manner without any misunderstandings. A credit agreement is also known as a loan agreement as its main topic is about the lender lending some money to the borrower.

Importance of Credit Agreement

A credit agreement template is used by many business facilities when the manager lends some money to their employees at the time of need or when someone takes a loan from a bank. By utilizing a credit agreement at the time of giving out a loan, the lender prevents the chances of disputes in the future over the deadlines. Everything is clearly mentioned in the agreement. Hence, it is important for the borrower to thoroughly go over all the elements written in the agreement. If they have any objections, they can be negotiated with the lender at the time of signing. However, the borrower has to take full responsibility for their actions once they have signed the agreement.

Characteristics a of Credit Agreement

Generally, a credit agreement includes the following factors:

Date: every agreement starts off with the date on which the agreement is being signed. Mostly, the date is written at the time of the deal.

Identification: it is important to specify who is the lender and the borrower, as well as mention their respective names, contact number, email and relevance.

Amount: the exact amount that will be lent to the borrower and how (by cash, credit, check, and deposits).

Compensation: the date on or before which the money will be compensated and how. The amount of interest that will be expected with the total payback, and if no interest is expected then it must be specified. Mostly the borrower is allowed to write these dates at the time of signature.

Effect of disloyalty: in case of not paying back the money on the expected date, there are certain terms and conditions stated that the borrower must acknowledge and agree to before signing the agreement. This usually includes filing some charges against the borrower or getting fired from their job.

Signature: the applicant is asked to sign the agreement as a form of acceptance of all the terms and conditions stated in the agreement form.

Details of Credit Agreement

The original copy of the credit agreement is kept with the lending party, while the replica is provided to the borrower. By having the original copy of the document, the lender can ensure that they have the legit document in case of any fraud. At the same time they can use this document if any disputes arise in the future regarding the amount of money lent or the deadline.

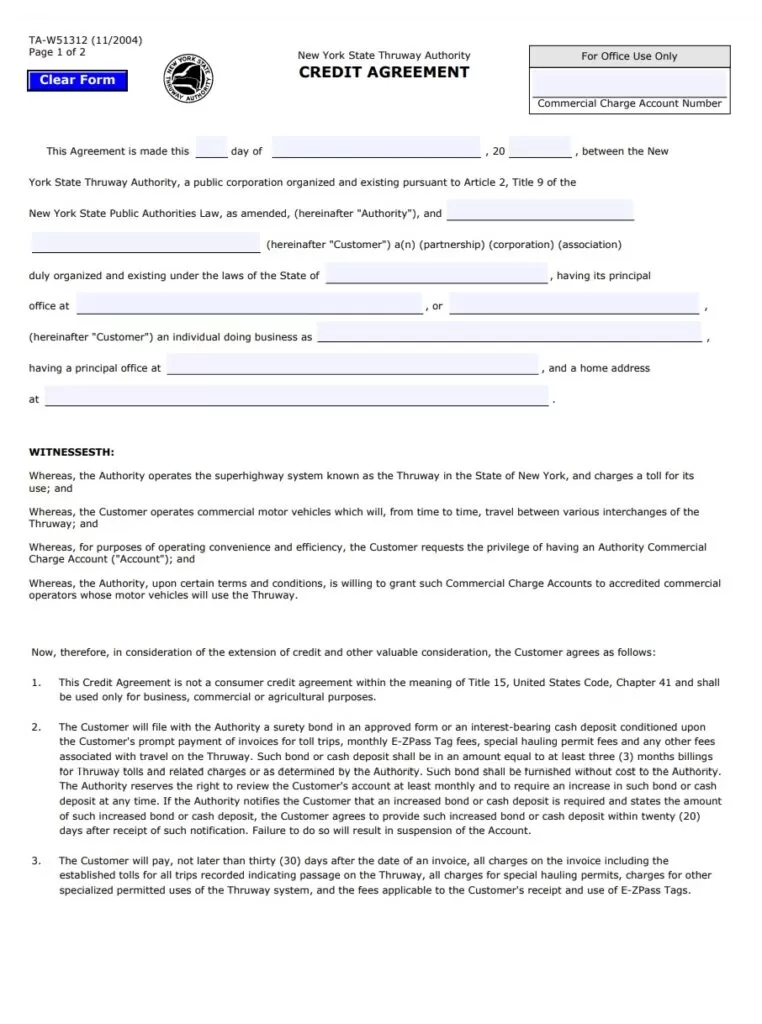

Template for Credit Agreement

www.thruway.ny.gov

www.thruway.ny.gov