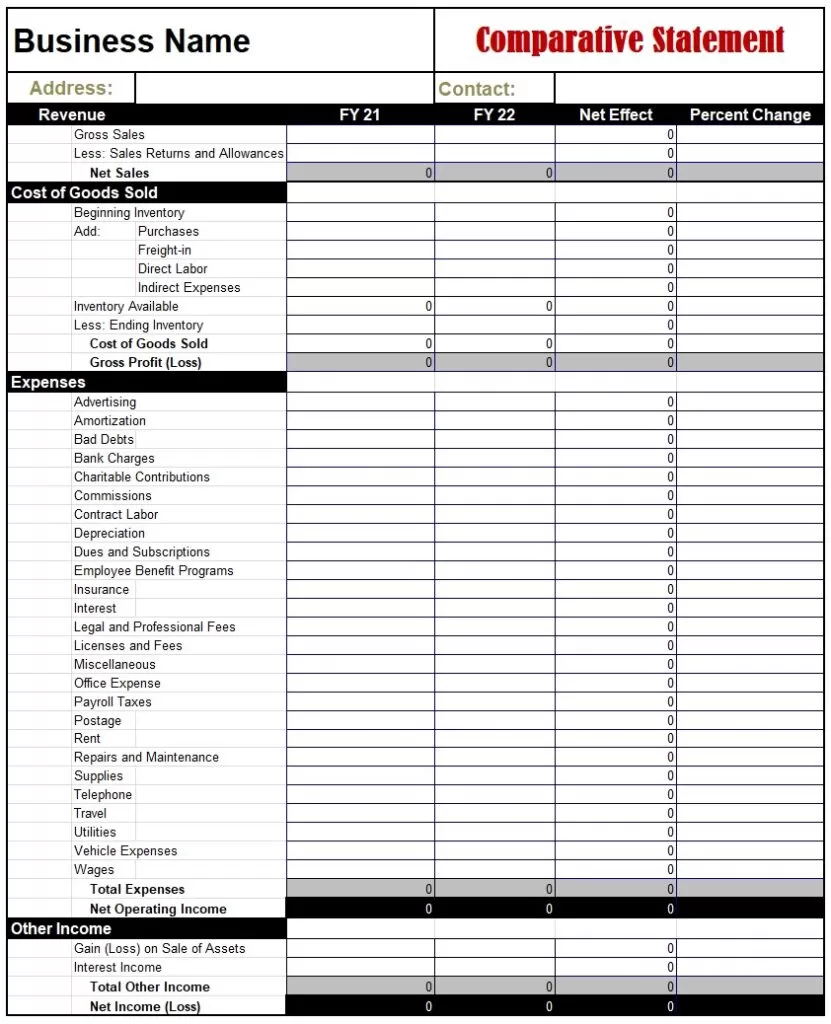

A comparative statement template is a comparative study between current financial statements with prior financial statements. Both current and previous findings are presented alongside each other to differentiate between the two and help investors identify the changes in the stock market and the progress noted. This is used to study changes in revenue, income, balance sheets and cash flow. This also helps to identify the current trends and help compete with rivals in the market industry, assuming they follow the same accounting principles. Through comparative statement template, with the gradual changes in the company, products can be evaluated according to the changes in the trends. Performance of the employees of the company can be monitored and changes in profit and loss can be identified.

Importance of Comparative Statement:

Comparative statement template can give results of the activities generated in a business. Yet, it is not sufficient enough to reach desirable conclusions; so hence thorough and deep financial analysis must be taken each year to determine the best comparative statement. This helps build a better relationship between the various components showcased in each analysis of the statement. Comparative statements become less reliable when a company undergoes huge situations, for instance; if a company merges with another, the large transition makes them into an entirely new entity, whose records differ from there previous statement.

Different Types of Comparative Statement:

• Comparative Income Statement: Comparative income statement provides the details about the results of the ongoing operations in a business and the progress made through them over the time period. It compares the changes that occurred between the start of the operation and the current state. This does not only compare the operational efficiency of a business but the ongoing trends with other competitors in the market industry. While analyzing comparative income statement, one should study the difference between increase, and decrease in the goods sold, the operation proficiency of a business; the profitability in the stocks of a business, calculating the net profits with the help of net income or balance sheets. As stock values change gradually, so the total percentage should be generated while keeping the current and the previous values in mind.

• Comparative Balance Statement: Comparative balance sheet analyses the assets and liabilities in a business over the current year as well as the previous year. This comparison does not take place only collectively but also on individual changes throughout the year. Comparative balance sheets also study the increase and decrease in assets and liabilities over different accounting periods. These changes are notified while studying the previous and current year differences. With the help of the balance sheet, changes in cash flow and net income give a statement of liquidity and equity in a business. This basically refers to the financial condition over a long and short term period of time and the profitability rate over the course of years. This helps investors identify the assets that need to be maintained according to the ongoing trends and also build a plan to help eradicate liabilities in the underlying business.

Comparative Statement Template