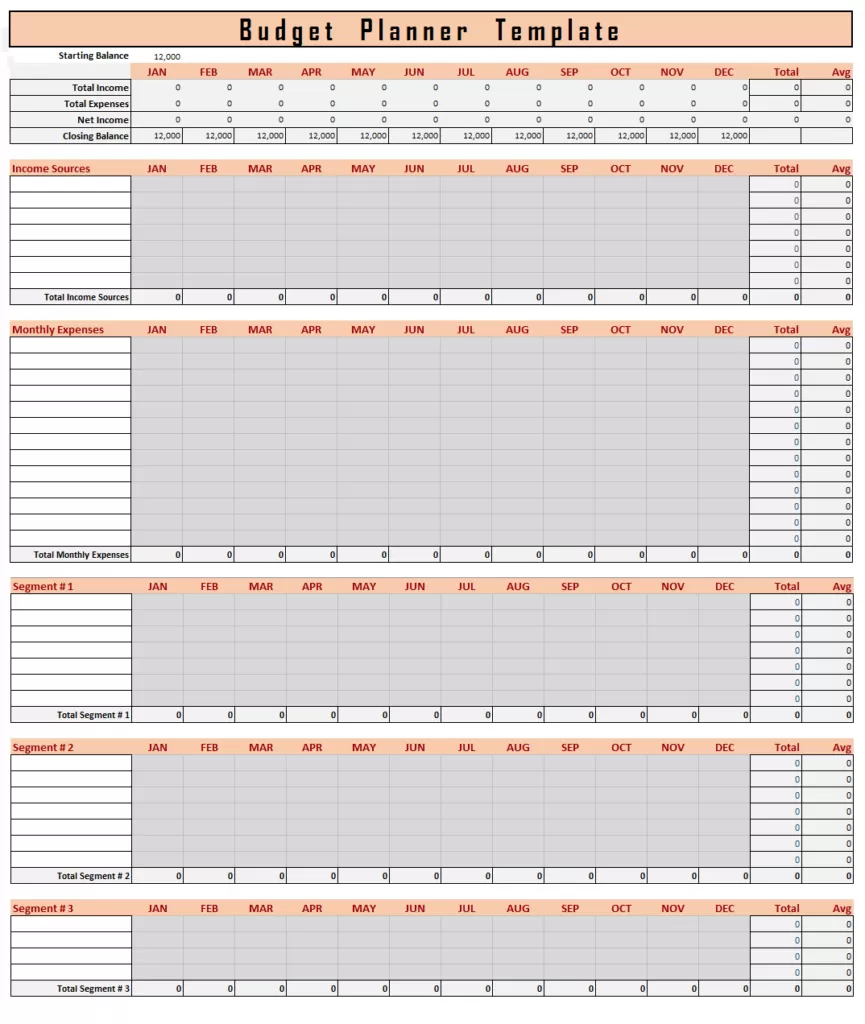

A budget planner template is a flow chart or a graphical data presentation that shows how your money will flow inwards and savings will be for a specific period. A budget planner template can be prepared either on a monthly basis, weekly or a yearly basis. Moreover, it allows you to forecast your future financial position based on previous year’s data. So, you can manage all your financial tasks, capital expenses and other matters accordingly. This planner is used by individuals for day-to-day expenses as well as for businesses to estimate their coming expenditures. For an individual, it allows you to decide where you are overspending on useless things and where you overcame bad habits of spending. By working on your own budget planner, you can actually make a big change and, by a slight adjustment in your budget, you can have the ability to save more than usual.

How Significant is a Budget Planner?

In this modern age, financial crises are faced by everyone. It can be a mother, student, small shop owner or a business person. Normally, these problems are caused by internal factors like unemployment, family illness or overspending. By keeping track of your earnings and spending, it will be easier for you to know where your budget is exceeding and how you can mitigate it. A budget planner template is designed to have control over your finances and, with proper planning, you can improve your financial conditions. By having a record of your budget throughout the year or month, you can consider both your current and future expenses and savings.

Advantages of a Budget Planner

• A budget planner guides you about whether you are going in the right direction financially. Everyone has set some future goals, like buying a house or starting up a new business. So, it is important to set some guidelines to achieve your goals because that budget plan is something that alerts you about going in the wrong direction.

• It helps you control your money instead of money controlling you in future.

• By using a realistic budget planner and following it, you can save your cash, which can be used in time of need or on real things that matter.

• This planner assists you or your entire family or staff to focus on common or desired objectives which need to be achieved. It helps you build up for future emergencies or unexpected expenses that will be difficult to deal with.

• A budget planner template keeps you out of debt or, if you have any debt, It will help you get out of it as well.

• By following your budget planner, you can create some extra money which can be used or spend on things which spent on you.

How to Prepare a Budget Planner?

There are the following steps that can be considered when making a budget planner. First you should compute your monthly income, which is an important step. Next, keep track of your monthly spending and categorize your expenses and can highlight the area where your money is spent the most. After considering your income and spending now, it is a time to achieve a real goal for yourself to achieve. Now it is the time to prepare a plan and start working on it. Lastly, focus on your goals and adjust your acts or spending to stay on your budget and stop spending on useless things.

Template for Budget Planner