A promissory note template is a legal document which is needed, during the process of giving and taking loan. This document is inevitable, when a loan amount is credited or disbursed to another party or client, either as a result of a business transaction or as part of a deal. The reason for it to be written is because it causes easiness for both persons, by mentioning some rules included in the process. It brings awareness in both persons mind to think what could be the consequences in case if rules are not followed. Moreover, if something goes wrong in the future, it ensures that everything goes according to a normal process.

Why a Promissory Note is Essential?

The promissory note is very important during the process of loan agreement. It will clear all the rules which are a part of the process. Moreover, it also gives the lender the right to take back its money, if the loaner is not giving the money back without any proper reasons. If the loaner has some reasons due to which he/she is not able to give money back on proper time, then he/she may be given some more time to repay it. However, if the loaner is in good financial condition and is not giving money back to you, despite he /she easily can, then at this time this document gives you the right to take your money back with the help of the court. You will go to court and show the agreement to your lawyer, and even at this point, you will need help with this document. Which will help in filing the case against the loaner. Then the hearing will be done and you will get your money back from the loaner by the court. If this situation arises then it might also give the loaner some punishment for not paying back the money on proper time despite of good financial situation. So it’s better to follow the rules of this agreement in order to save yourselves from all these problems.

How to Use Promissory Note?

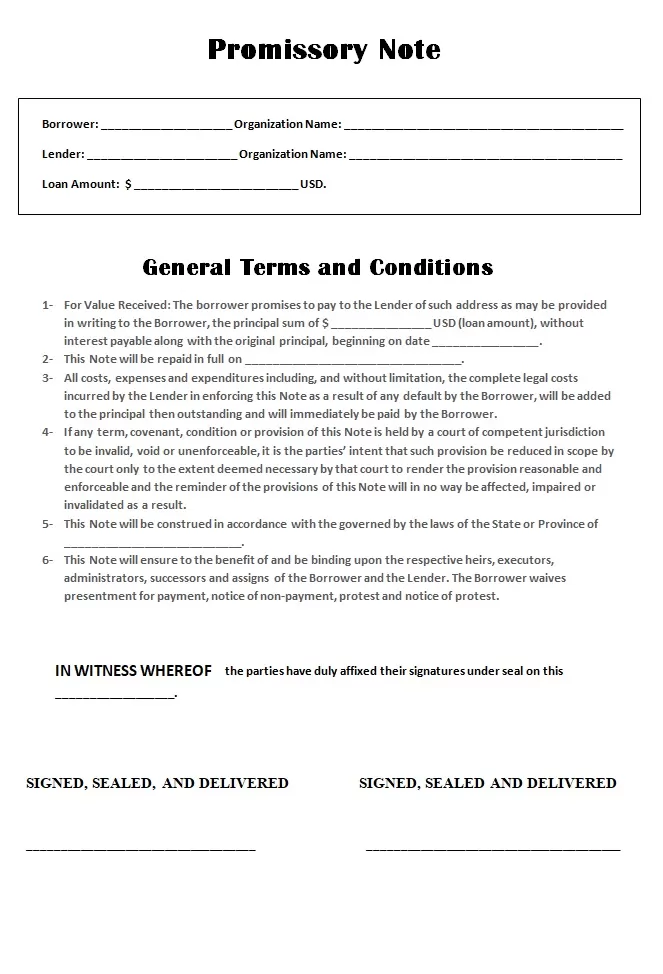

This requires you to fill in a form in which first the lender will write his/her name; then after that in next line his/her father name. Then on the other side, the lender will write his/her address. Then after that, in the next step, the lender will write the name of the loaner who is taking loan, and after that the loaner’s father name will be written in the form. After this the address of loaner will be required and on the next step the date with month and year will be mentioned in the form. Then the other step is optional which is used in case if the lender is giving, or if the loaner is taking loan in some percentages. If the loan is being given or taken in percentage than the one who is choosing, this step will write about how much percentage he/she is giving or taking? Also he/she will need to write its half percent as well, such as, if I am giving loan of 500 dollars I will write 250 dollars on the half percentage area. If percentage is not being used leave this area blank.

Promissory Note and Its Benefits

A promissory note helps in taking money back if the loaner is not giving back without any proper reason. You will know to whom or from whom you are taking or giving loan, where she/he lives. Most significantly, you can make sure if the person is worthy of giving loan to him/her or taking loan from him/her. You will be satisfied and no need for worries as you know if something goes beyond agreement the document will be helpful for you. The biggest advantage of using a promissory note is to give some sort of assurance to the lender regarding repayment as per their terms.

Template for Promissory Note