An expense controlling analysis template allows its users to conduct various analysis and tools to learn how they can limit their weekly or monthly expenses as per budget. Controlling expenses can be a very laborious and tiring task for most people. Specially, when it comes to managing expenses as a student, employee or minimum wageworker. For such people, it is a very hard task to manage their daily expenses, necessities and taxes. Mostly, companies also conduct such analysis to track the cash flow of their organization. This way they can acknowledge their unimportant and petty expenses and manage their future expenses. It helps companies to track their important expenses and eliminate the irrelevant ones from their monthly/daily expenses. It is basically a method of concluding the expenses made by the company.

Expense Controlling Analysis Process and Method

Organizations that carry out cash flow analysis, do that, so they can get a general insight about their financial health. Conducting an expense analysis is not a tough job if you plan it out wisely. The first step to every type of analysis or any operation is to roughly plan it out beforehand. Make a rough list of the things you need to remember while you are conducting the analysis. This technique helps you make sure that you are not forgetting or leaving out any main point. Down below, we have provided you a small list of things you must keep in mind while conducting an expense analysis;

1. Prepare a document on which you want to list down the outcomes of your analysis. This can be done on Microsoft Word or an Excel sheet.

2. Firstly, calculate your monthly/annual income. Mention all the places where your company is getting paid from. Which can be:

• Tangible and intangible income

• Business profits

• Sales

• Promotions

• Active and passive income, etc.

The total income received by the company should be summed up and mentioned separately.

3. Start listing down the company’s expenses (employee’s salary expense, legal fees, taxes and marketing expenses) each one of them should be mentioned separately with their specified amounts.

4. Then all the expenses should be totaled. The difference between the income and spent amount should be obtained.

This way, the person who is conducting the analysis gets an insight about all the places where their company’s money is being used. Additionally, it also helps them to realize the expenses that are unnecessary and can be eliminated without causing any damage or problem to the company’s financial or general status.

Benefits of Expense Controlling Analysis

The advantages that can be gained by conducting an expense analysis are very clear and obvious. Some main ones are mentioned below;

• Helps you to understand your monthly/annual cash flow.

• makes it easier for you to organize your company’s upcoming expenses.

• Conducting an expense flow analysis can make a lot of your troubles easier. Such as, once you have a proper expense list of your company, you will allot a specific amount for each of the expenses. This will make it very easy to pay the exact amounts when required.

• This way you can reduce the chances of errors and frauds because you already have an estimate about the amount that should be paid.

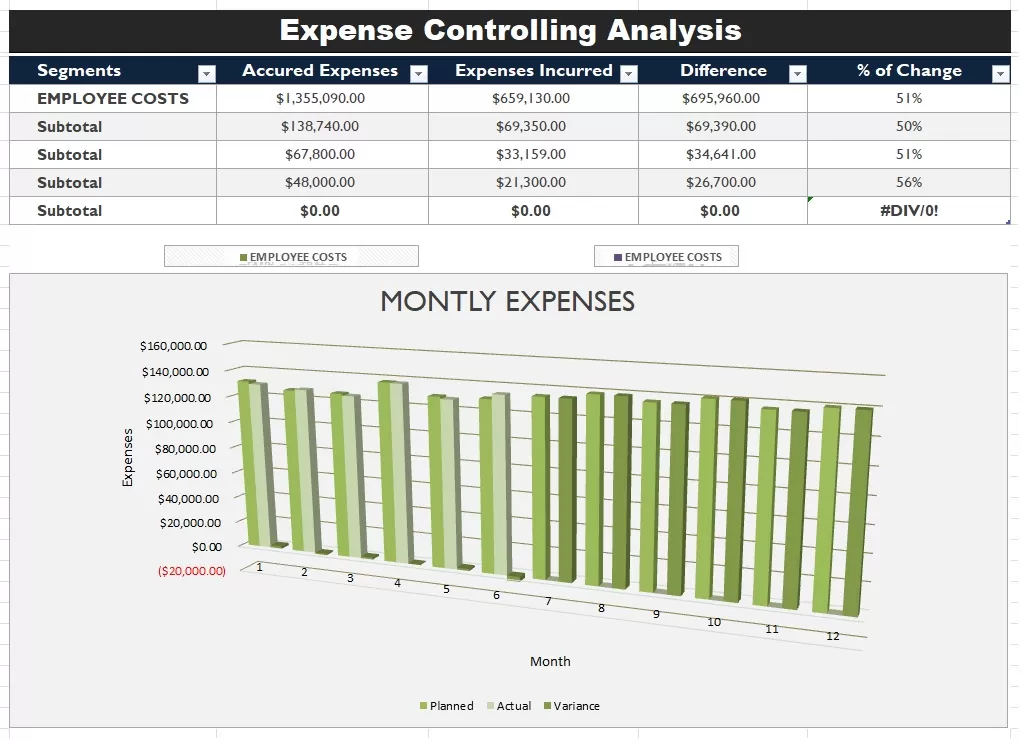

Template For Expense Controlling Analysis